IRS Tax Notices Explained

You filed your taxes, processed all of your W-2s and 1099-Cs and think your federal reporting is in great shape – until you receive the dreaded IRS tax letter. Your stomach knots, your mouth goes dry and suddenly a clammy panic takes hold. “Be calm!” says Appletree Business Services owner Steven Feinberg, CPA. “There are all kinds of notices and letters the IRS can send, so take a deep breath and review the letter carefully,” he continues. Often there are ample instructions on what the IRS needs a taxpayer to do. In the event you have questions, you can always reach out to the IRS directly or contact your local Professional Small Business Advisor.

The IRS sends notices and letters for a variety of reasons. The most common are:

- There’s a balance due.

- The taxpayer is due a larger or smaller refund that what was originally filed.

- There is missing or unreported income from another source.

- The IRS has a question regarding the tax return.

- Random selection – that’s right, each year the IRS randomly selects taxpayer reviews based on a statistical algorithm.

- The IRS needs to validate the taxpayer’s identity – i.e. the SSN doesn’t match the name.

- The IRS made a correction or change to the return.

- The IRS is notifying of a delay in the return.

- Final notice of intent to levy and notice of your right to a hearing.

If your correspondence indicates that a response is requested, it is in your best interest to respond within the given time frame to help reduce or eliminate additional penalties, or preserve your right to appeal if you don’t agree with their findings. If you are required to respond or take action in the letter, you will want to include the CP or LTR number found on either the top or bottom right-hand corner of the correspondence. Be sure to take down the agent’s ID number, name and the date and time you spoke.

Let’s review the most common types of IRS letters and what they might mean for your situation.

CP2000 Notice – issued when the income and/or payment information doesn’t match information reported on the tax return.

CP11 – This letter is sent when there are changes to a tax return or a balance due. The IRS has made a change to the tax return and there is now a balance due.

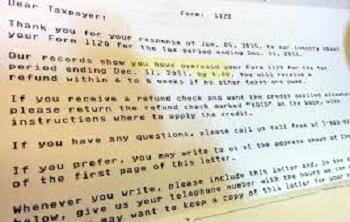

CP12 Notice – This notice is issued when the IRS corrects one or more mistakes on a taxpayer’s return and a payment has become an overpayment or an original overpayment amount has changed.

CP-90 – Final Notice of Intent to Levy and Notice of Your Right to a Hearing – This is the only notice that permits the IRS to take action against a taxpayer. If you have received this notice, you have already received several other communications from the IRS. Once this notice is delivered, you have 30-days before the IRS is legally entitled to take action. You can request a meeting with an IRS appeals officer or start collection due process.

If you are required to pay additional taxes to the IRS and you agree with their findings, you still have a few options available to you:

- Pay the amount due in its entirety

- Pay a portion of what you owe

- Apply for an Online Payment Agreement or Offer in Compromise.

A note about IRS letters: Beware of suspicious notices or letters that were designed to look like they came from the IRS. If you are suspicious, you can call the IRS hotline at 1-800-829-1040. Remember that the IRS will never ask taxpayers for personal information via email or social media sites.

PASBA member accountants bring the collective resources of a nationwide network of Certified Public Accountants, Public Accountants, Enrolled Agents and other practitioners available to answer your tax and financial questions and streamline your business accounting, bookkeeping, and payroll operations.

To find a trusted accountant in your area, visit www.SmallBizAccountants.com.

Please be advised that, based on current IRS rules and standards, any advice contained herein is not intended to be used, nor can it be used, for the avoidance of any tax penalty that the IRS may assess related to this matter. Any information contained in this article, whether viewed or subsequently printed, cannot be relied upon as qualified tax and accounting advice. Any information contained in this article does not fall under the guidelines of IRS Circular 230.